LIC INVESTED Rs. 48,284 CRORE IN ADANI GROUP

The government informed the Lok Sabha that the Life Insurance Corporation of India (LIC) has invested a total of Rs 48,284.62 crore in seven companies of the Adani Group, including both equity and debt. The ministry stated that the government has no role in investment decisions and that LIC follows all regulatory procedures.

LIC INVESTED Rs. 48,284 CRORE IN ADANI GROUP

7-DEC-ENG 1

RAJIV NAYAN AGRAWAL

DELHI----------------------------The government informed the Lok Sabha that the Life Insurance Corporation of India (LIC) has invested a total of Rs 48,284.62 crore in seven companies of the Adani Group, including both equity and debt. The ministry stated that the government has no role in investment decisions and that LIC follows all regulatory procedures.

Two months ago, it was reported that the Narendra Modi government had quietly devised a $3.9 billion plan to bail out Gautam Adani's debt-ridden group using funds from the Life Insurance Corporation of India (LIC). Now, the government has informed Parliament that LIC has invested a total of Rs 48,284.62 crore in Adani Group companies, comprising Rs 38,658.85 crore in equity (shares) and Rs 9,625.77 crore in debt.

According to the written information provided by Finance Minister Nirmala Sitharaman, this data is based on information available as of September 30. She also stated that LIC has made an additional investment of Rs 5,000 crore in secured non-convertible debentures of Adani Ports and Special Economic Zone Limited. In its response to questions from MPs Mohammad Javed and Mahua Moitra, the government did not provide a complete list of all private companies in which LIC has invested.

The government said that providing a ‘complete and detailed list’ of companies in which LIC has invested would be ‘commercially inappropriate and could prejudice LIC's operational and lending interests.’

The MPs had asked the following questions: (a) Is it true that LIC has recently invested in the Adani Group, which is currently under investigation by regulatory agencies? If so, please provide details of the total investment made in this regard. (b) Did the Ministry of Finance or the Department of Financial Services (DFS) issue any instructions or advice to LIC or other government financial institutions regarding investments in Adani Group companies? If yes, please provide details and the reasons behind them. (c) What kind of due diligence, risk assessment, and fiduciary compliance processes were followed before making such investments? Was any consultation held with SEBI or RBI during this process? (d) Has the government reviewed the potential impact of these investments on policyholders, market transparency, and institutional independence? And what steps have been taken or are being taken to ensure transparency and accountability? (e) How many Adani Group companies does LIC currently have investments in? What is the total amount of these investments company-wise? Also, what are the details of when and how much LIC first invested in Adani Group companies? (f) What is the list of all private sector companies in which LIC has invested, and what is the amount invested in each company?

According to the government, the ₹5,000 crore investment made by LIC in secured NCDs issued by Adani Ports Special Economic Zone (APSEZ) in May 2025 was made after due diligence and in accordance with board-approved standard operating procedures (SOPs). In its response, the Ministry of Finance also claimed that the Ministry does not issue any advice or instructions to LIC regarding investment matters.

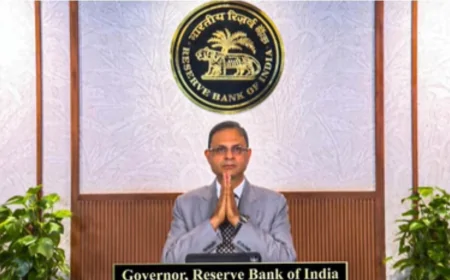

The government stated: LIC makes its own investment decisions. It makes investments with due diligence, risk assessment, and fiduciary compliance. All these decisions are taken under the Insurance Act, 1938, and the regulations issued from time to time by the Insurance Regulatory and Development Authority of India (IRDAI), the Reserve Bank of India, and the Securities and Exchange Board of India (SEBI). A Washington Post investigation revealed that the Finance Ministry, its Department of Financial Services (DFS), LIC, and the NITI Aayog think tank collaborated to devise an investment strategy, under which billions of rupees were invested in Adani Group bonds and shares. The report stated that this plan included a $585 million bond issue, which was funded solely by LIC. The government's response stated that LIC's investments generally reflect its practice of investing in the top 500 companies listed on the NSE and BSE, with the majority of its investments concentrated in large-cap companies. According to the government, as of September 30, 2025, LIC's book value of investments in Nifty-50 companies is ₹4,30,776.97 crore, which constitutes 45.85% of its total equity investments. LIC has a debt investment of ₹9,625.77 crore in Adani Ports and SEZ Limited, which is its fifth largest debt investment in the private sector. LIC's investments are spread across seven Adani Group companies: Adani Enterprises Limited, Adani Total Gas Limited, Adani Green Energy Limited, Adani Energy Solutions Limited, APSEZ (Adani Ports and SEZ), Ambuja Cements Limited, and ACC Limited.

The government also provided details on LIC's exposure to the Adani Group compared to its total investments in the public and private sectors, and its ranking. The corporation's investment activities are subject to scrutiny by Concurrent Auditors, Statutory Auditors, System Auditors, Internal Financial Control (IFC) Auditors, and an internal vigilance team. In addition, the sector regulator IRDAI conducts periodic inspections. The government does not have direct control over the investments made by LIC. There is no control. The chart presented by the government also shows that LIC's investment in Adani companies was very low in 2007.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0