11 YEARS OF SUKANAYA SAMRIDHI YOJANA

The Sukanya Samriddhi Yojana (SSY) completed 11 years on Thursday. This scheme has emerged as one of the most impactful social and financial schemes launched for the daughters of the country, which not only promotes savings but also offers hope for a secure and self-reliant future for daughters.

11 YEARS OF SUKANAYA SAMRIDHI YOJANA

24-JAN-ENG 2

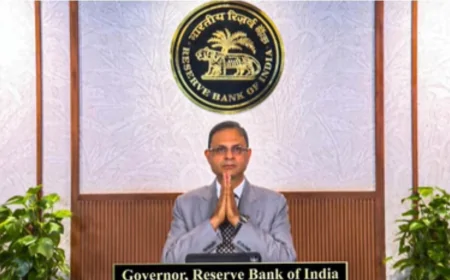

RAJIV NAYAN AGRAWAL

DELHI-------------------------------The Sukanya Samriddhi Yojana (SSY) completed 11 years on Thursday. This scheme has emerged as one of the most impactful social and financial schemes launched for the daughters of the country, which not only promotes savings but also offers hope for a secure and self-reliant future for daughters.

This scheme was launched on January 22, 2015, under the 'Beti Bachao, Beti Padhao' (Save the Daughter, Educate the Daughter) campaign. Its objective was not merely to accumulate money, but to encourage families to plan in advance for their daughters' education, health, and self-reliance. Over the years, this scheme has generated awareness and trust in every corner of the country.

By January 22, 2026, when the Sukanya Samriddhi Yojana completed 11 years, more than 4.53 crore accounts had been opened under it. This figure shows that people across the country are now becoming more aware and responsible about their daughters' future.

The Sukanya Samriddhi Yojana currently offers an annual interest rate of 8.2 percent, which is considered the highest among government schemes designed for daughters. The amount deposited and the interest earned on it are fully secured by the Government of India, making it a reliable and low-risk investment.

This scheme is specifically designed to help with the education and marriage expenses of daughters. It helps girls become financially strong and self-reliant, which furthers the goal of women's empowerment.

The parents or legal guardians of a daughter can open a Sukanya Samriddhi account at any post office or authorized bank branch. This account can be opened from the time of the girl's birth until she turns 10 years old.

Only one account can be opened for each daughter. A maximum of two accounts can be opened in a family, although there is an exception in the case of twins or triplets. This account can be transferred anywhere in India. Until the age of 18, the account is operated by the guardian, after which the daughter can manage it herself.

To open a Sukanya Samriddhi account, you need an account opening form, the daughter's birth certificate, Aadhaar number, and PAN card or Form 60.

By December 2025, the total deposits in this scheme had exceeded ₹3.33 lakh crore, clearly demonstrating its popularity.

A minimum of ₹250 and a maximum of ₹1.5 lakh can be deposited annually in this scheme. Deposits can be made for 15 years from the date of account opening.

Interest is calculated monthly and credited to the account at the end of each financial year, allowing the amount to grow continuously.

After the daughter turns 18 or passes the 10th grade, up to 50 percent of the deposited amount can be withdrawn for her education. This amount can be withdrawn in a lump sum or in installments, provided that documents related to her education are submitted.

The Sukanya Samriddhi account matures after 21 years. Premature closure is allowed only under certain circumstances, such as the daughter's marriage (after the age of 18) or death. The account cannot be closed during the first 5 years.

Due to its high interest rate, tax benefits, and withdrawal facility for education, the Sukanya Samriddhi Yojana is considered one of the best long-term savings schemes for daughters. It instills a habit of saving in families and secures the future of daughters.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0